CoinAPI powers crypto tax calculation service

Learn How Bitcoin.tax Utilizes the Crypto Tax API

to Power Their Crypto Tax Calculation Service

About Bitcoin.tax

Bitcoin.tax, formerly known as BitcoinTaxes, was established in 2014 as the pioneer cryptocurrency income and tax calculation service. It gained popularity among the growing crypto population who wanted to ensure that they were filing their tax returns accurately. In addition to serving individual users, the platform also caters to tax professionals and firms who offer crypto tax services to their clients using its software. We recently spoke to Colin Mackie, the CEO of Bitcoin.tax, to understand why integrating with a crypto tax API is crucial for running accurate crypto tax calculations.

"CoinAPI does what a good crypto API is supposed to do: quickly and easily provide live data on any cryptocurrency and the trading volume of each of them. We use CoinAPI to power our tax calculation,"explains Bitcoin.tax CEO Colin Mackie

The Importance of Cryptocurrency Tax Software and CoinAPI Integration

Crypto taxes are gaining significance among investors and traders due to the growing popularity of cryptocurrencies. It has become essential for anyone involved in the cryptocurrency market to understand crypto taxes, especially with the rise of Bitcoin, Ethereum, and other digital currencies. Although crypto taxes can be complicated, they can be managed with the right software. The emergence of digital currency has sparked an interesting debate among investors and governments worldwide regarding how crypto taxes should be handled. As more people invest in digital currency, the need to properly calculate taxes has become increasingly important.

Calculating taxes related to cryptocurrencies is a complex process, and different countries have different regulations. Hence, cryptocurrency tax experts are in high demand to help investors manage their crypto tax-related obligations. Bitcoin.tax is one such company that provides such services, and we recently interviewed its CEO Colin Mackie. He explained why integration with CoinAPI is crucial for tax and accounting companies.

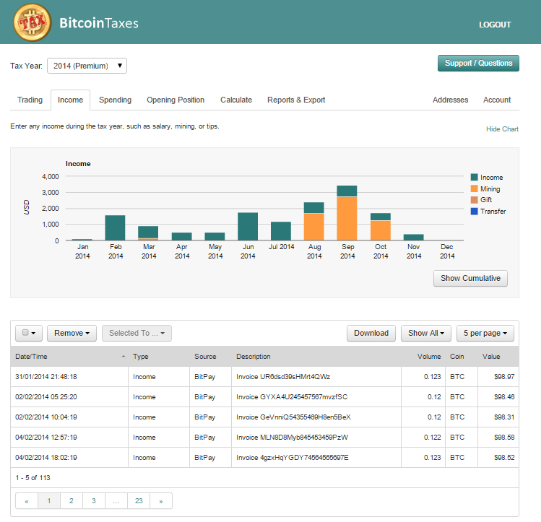

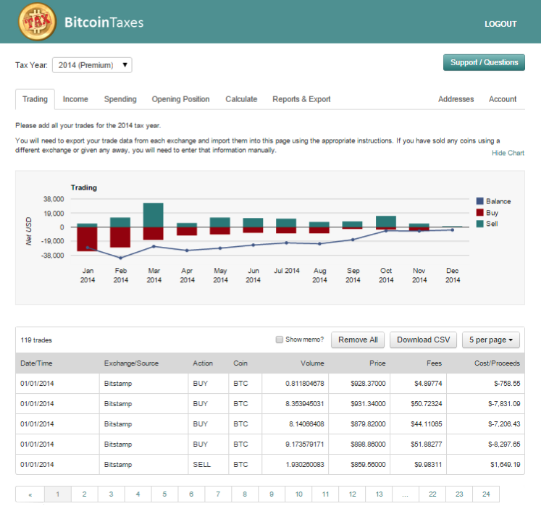

"Individuals trading in digital currencies are required to pay taxes, and for this to be done efficiently, they need software that can precisely calculate their capital gains and losses. Crypto tax software streamlines this process, easily integrating with various crypto exchanges and wallets and rapidly producing tax reports. Bitcoin.tax unquestionably stands out as the most useful tax tool for digital currencies. It not only monitors crypto portfolios but also creates accurate tax reports, offering compatibility with numerous wallets and exchanges. Moreover, Bitcoin.tax is user-friendly, making it a suitable choice for both novice and seasoned traders," stated Colin Mackie, the CEO of Bitcoin.tax.

The challenge

Bitcoin.tax requires precise spot and historical pricing details from various cryptocurrency markets for different exchanges to calculate taxes accurately. For this, they need extensive and accurate pricing information to generate the correct values for filing taxes. CoinAPI offers historical price data gathered from commonly used exchanges and a real-time feed of trades occurring on those exchanges. By linking with the API, Bitcoin.tax can identify taxable transactions, calculate gains, losses, and income to create multiple crypto tax reports, which can help investors in filing with their country's tax agencies quickly and efficiently.

"Our partnership with CoinAPI is focused on delivering the most dependable historical and current cryptocurrency data for tax computation. Given the different regulations in each jurisdiction, preparing tax filings can be demanding, particularly when calculating profits from trading cryptocurrencies. Bitcoin.tax facilitates the creation of crypto tax reports for traders effortlessly. This alliance is timely, considering the growth of our user base and their increasing demands for their evolving trading platforms," expressed Colin Mackie, CEO and Founder of Bitcoin.tax.

Here are the challenges Bitcoin.tax faced

No single source of historical and real-time cryptocurrency price data

To get the latest updates on cryptocurrency prices, developers and traders need to use a mix of various Crypto APIs and Market Data APIs. There is no one-stop solution for this. Bitcoin.tax was searching for an API that offers access to a range of data sources, including cryptocurrency exchanges.

Lack of real-time streamlined data

Businesses face a significant challenge when it comes to obtaining up-to-date and organized data. As companies shift from conventional data solutions to more rapid and efficient ones, the demand for precise market data is only increasing. Fortunately, there are resources available, such as Crypto API and Market Data API, which can provide a comprehensive array of real-time data to assist businesses in making more informed decisions.

The manual process of getting data from multiple sources

Getting data from multiple sources through a manual process can be quite laborious and time-consuming. It demands a lot of skill and dedication to gather information from various sources. For example, to obtain market data, one needs to explore different websites and market data providers manually to find the relevant data. Similarly, to get crypto tax data, one has to browse through various crypto exchanges to locate the appropriate data.

The solution

Bitcoin.tax has chosen CoinAPI as its go-to source for cryptocurrency data. This is because CoinAPI has a proven track record of being a reliable source of tax information over the years. By utilizing CoinAPI's API, Bitcoin.tax can now perform tax calculations for all major cryptocurrencies. This market data API allows tax and accounting software to seamlessly communicate with each other, leading to improved efficiency, automation of tasks, and better staff retention. Many tax and accounting firms use up to 40 applications, which can be difficult to manage. CoinAPI simplifies this process.

Results

Bitcoin.tax chose to use CoinAPI because of its reliability in providing accurate cryptocurrency data through an API, which is crucial for precise tax calculations.

"Having access to a broad spectrum of crypto data is truly transformative," shared Colin Mackie. "The API is incredibly user-friendly, making it effortless to gather the necessary data."

Bitcoin.tax has recently launched a new feature that allows their customers to receive personalized tax calculations according to their individual investments. For this purpose, Bitcoin.tax has relied on CoinAPI, which provides accurate data and has been a reliable and cost-effective choice for the company for quite some time. This has helped them in their investigations of various strategies related to digital currency trading.

Here's why Bitcoin.tax uses CoinAPI's API to run crypto tax calculations

Get access to historical and real-time streamlined data

CoinAPI is a platform that offers historical price data from the most frequently used exchanges. Additionally, it provides a live stream of trades occurring on those exchanges.

Getting spot time data

CoinAPI is a useful tool that offers spot pricing information for various exchanges. The API is designed to help developers quickly access and integrate market data into their applications. This feature is particularly essential for crypto tax companies that require the latest pricing information to make accurate tax calculations.

Saving time in getting data

The integration of tax and accounting applications through market data APIs can offer multiple benefits to organizations. With up to 40 programs being used, managing them can become a tedious task. However, APIs and integrations can help in avoiding errors and saving time on repetitive data input jobs. This not only enhances the consumer experience but also reduces costs for the organization. By automating tasks and improving staff retention, market data APIs can significantly increase efficiency.

Making integration quick and simple

An API integration platform can help teams to swiftly and effortlessly connect various technologies, and even showcase current integrations as APIs or microservices to introduce new applications to the market. The use of APIs comes with the added benefit of automating previously impossible business processes, as well as creating smooth integrations between cloud services, and generating automated reports and dashboards. APIs also allow you to establish connections between multiple services, thereby closing loops.

Providing multiple price sources

Our Market Data API provides you with real-time and historical market data for a range of asset classes, such as stocks, futures, options, commodities, and currencies. No more dealing with the hassle of manual data entry or juggling multiple sources. This is an ideal solution for tax and accounting software that requires consolidated financial data from a variety of sources. The Market Data API grants you access to the latest market news, price quotes, and other financial data from top exchanges and vendors.

The most accurate crypto pricing thanks to access to crypto tax API to run crypto tax calculation

It is crucial for tax and accounting firms to prioritize data quality to avoid costly mistakes and ensure accurate tax calculations. Reliable and consistent crypto market data is essential to determine the correct tax amount based on the information gathered. Therefore, the data used for such calculations must be dependable, relevant, complete, and accurate.

Data standardization and mapping

Tax companies require accurate cryptocurrency names and mappings to ensure data normalization. It is crucial to standardize data collection using CoinAPI to obtain a complete and precise crypto data picture that can be practically applied. CoinAPI has its database, which is also utilized for exchange rate calculations.

“By working with CoinAPI, Bitcoin.tax was able to gain access to the desired exchanges' APIs, and once the procedure is complete, all the data is imported automatically with no user input required,” said CEO and founder Bitcoin.tax Colin Mackie