CoinAPI’s cryptocurrency data API guide

Real-Time exchange rates

At CoinAPI, our crypto exchange rates, a key aspect of CoinAPI’s cryptocurrency data API, are calculated using the 24-hour Volume Weighted Average Price (VWAP-24H). This calculation is derived from a variety of high-quality data sources, with a specific focus on “SPOT” data types. We meticulously exclude any data from sources that are not deemed legitimate. Our approach involves a combination of quotes, trades, and metadata datasets, applying strict criteria for spreads in quotes and placing a strong emphasis on midpoint data for accurate pricing.

Trade volumes are integral to our VWAP24 algorithm, another component of CoinAPI’s cryptocurrency data API. We give utmost priority to data freshness, updating the last 24-hour volume for each symbol every 4 hours and ensuring continuous updates every second. The algorithm is further enhanced with statistical filtering and a preference for high-ranking exchanges, ensuring the provision of the highest quality data. Lastly, we utilize a tree structure based on the VWAP24 data to determine the final exchange rates, guaranteeing that our users have access to the most current and accurate exchange rates as part of CoinAPI’s cryptocurrency data API.

Historical analysis with CoinAPI’s cryptocurrency data API

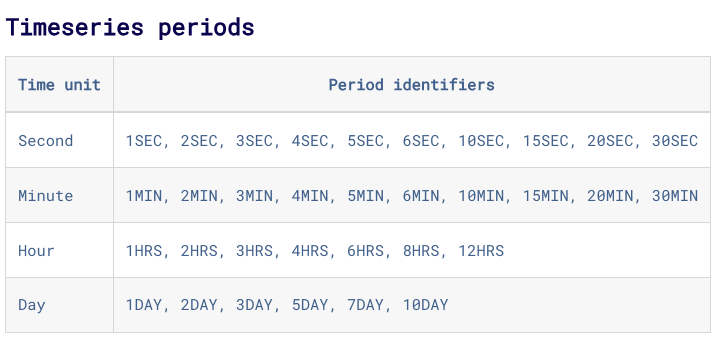

Timeseries periods

CoinAPI enables you to delve into the historical exchange rates of any asset pair, conveniently grouped into various periods. This feature is designed to cater to diverse analytical needs, whether you require granular data for short-term analysis or broader overviews for long-term trends. Below is a comprehensive list of the supported periods available for requesting historical time series data:

With this range of time-series periods, CoinAPI’s cryptocurrency data API provides unparalleled flexibility, allowing you to access the exact historical data you need, tailored to your specific time frame requirements.

Quotes

CoinAPI offers a dynamic Quote Updates Feed, focusing on Order Book Level 1 data. This service provides real-time updates on the latest quotes, capturing the most immediate bid and ask prices for various asset pairs. Ideal for traders and analysts seeking up-to-the-minute market information, our feed ensures you have access to the forefront of market changes as they happen. With this tool, you’re equipped to make informed decisions based on the very latest market data.

Trade volume data

CoinAPI is renowned for its comprehensive trade data, a cornerstone of our market analysis tools. This data encompasses critical details such as the trading symbol, precise timestamp, transaction price, quantity, and the buyer’s and seller’s order IDs. Such depth and granularity make our trade data an essential resource for traders and analysts who require a real-time, nuanced understanding of market movements. Users can access the latest trades executed up to just 1 minute ago, with the most recent information always presented in descending chronological order. This ensures that you are always working with the most current and relevant market data available.

Metadata

CoinAPI provides a comprehensive suite of metadata services, offering in-depth insights into the cryptocurrency market. Users can access a full range of asset icons in various sizes, perfect for visual representations in applications and reports. Our assets listing includes a complete overview of all cryptocurrencies, sortable by asset ID. For exchange data, we offer lists sorted by exchange ID and detailed lists of all exchanges, providing a deep dive into the available trading platforms. Our symbols data service includes a complete list of trading symbols, with optional filters for precision, and exchange-specific symbols for a more focused analysis.

Additionally, we provide iconography for exchanges, aiding in easy identification and graphical representation. Symbol mapping for each exchange is also available, essential for understanding the relationships between different trading pairs and exchanges. CoinAPI’s metadata services are a valuable resource for anyone needing organized and accessible information about the crypto market.

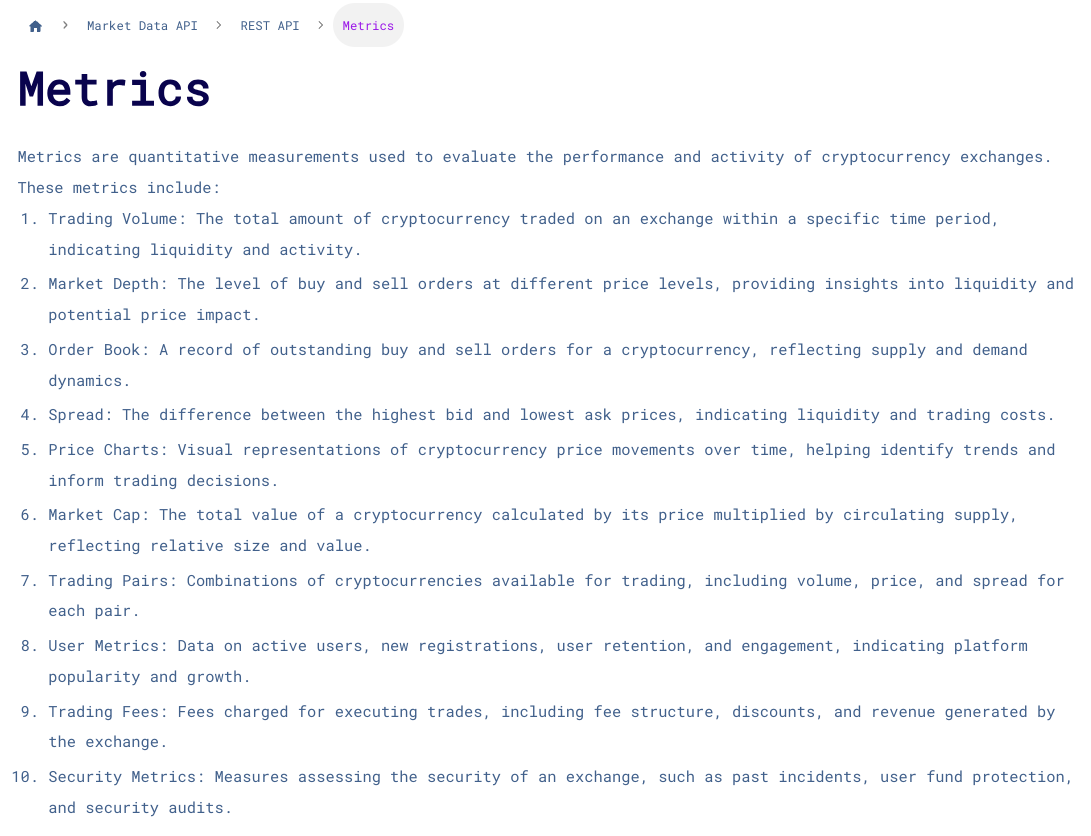

Metrics

CoinAPI offers a wide array of metrics to evaluate cryptocurrency exchanges, providing key insights into their performance and market dynamics. These metrics include:

These metrics from CoinAPI are crucial for a thorough understanding of cryptocurrency exchanges, their operations, and market behavior.

Order book data: Levels 1, 2, and 3

CoinAPI provides detailed order book data across three levels, each offering varying insights into market dynamics:

Order Book Level 1 (L1): This basic level gives a snapshot of the market, ideal for a quick overview of current conditions and high-level market dynamics.

Order Book Level 2 (L2): A more detailed level, L2 includes information on new and changing price levels, removed price levels, and individual trades, suitable for those needing deeper market insights.

Order Book Level 3 (L3): The most detailed level, L3, offers comprehensive data including new, canceled, and matched orders, linking trades directly to order book orders. This is especially useful for high-frequency trading and detailed market analysis.

CoinAPI’s REST API allows access to the current order book for specific symbols and their depth. Additionally, our WebSocket API provides real-time L2 order book data, ensuring the latest information is readily available for trading and analytical purposes.

Order Book Snapshots

CoinAPI offers a range of order book snapshots to suit various analytical needs, with intervals ranging from tick-by-tick to longer spans like 10ms, 100ms, 1s, and 10s. This variety allows users to choose the level of detail that best fits their trading and analysis strategies. The service includes:

Order book snapshots feed (Level 2): Provides a complete snapshot of the order book with real-time updates, offering a thorough view of market dynamics.

Book 5 – Order book snapshots feed (Level 2): Concentrates on the top 5 levels from each side of the book, giving a succinct yet detailed snapshot of market depth.

Book 20 – Order book snapshots feed (Level 2): Broadens the scope to include the top 20 levels from each side, offering a more comprehensive look at market orders.

Book 50 – Order book snapshots feed (Level 2): Provides an extensive overview of the top 50 levels from each side of the book, ideal for deep market analysis.

These diverse snapshot options from CoinAPI provide the tools necessary for close market monitoring and analysis, ensuring users have access to the detailed data needed for informed decision-making.

Real-Time order book updates

CoinAPI stands out for its ability to deliver real-time order book updates, a vital tool for market participants requiring the most current data. Each update from our platform includes comprehensive details such as the price level, the number of orders at that level, whether the orders are buy or sell, and the precise timestamp. These updates are transmitted within milliseconds, making them indispensable for trading strategies that depend on immediate market data.

Additionally, CoinAPI offers a WebSocket endpoint for seamless real-time market data streaming. This feature ensures that users have continuous access to live market dynamics, enabling them to react swiftly to market changes and maintain a competitive edge in their trading and analysis.

Quotes

Quotes are crucial for traders and investors who depend on current information for making informed decisions. They typically include bid and ask prices, providing a snapshot of the current market demand and supply, and are a vital tool for assessing the market. In cryptocurrency, quotes are particularly important for algorithmic trading, where accuracy and speed are essential. They also form the basis for market analysis, aiding in identifying trends and gauging market sentiment. Additionally, quotes are used as reference points for executing trades, ensuring that transactions reflect the latest market conditions.

Crypto OHLCV data (Open, High, Low, Close, Volume)

OHLCV data is a comprehensive summary of market activity within a specific timeframe, capturing crucial market movement aspects. This data is fundamental to technical analysis, helping traders identify market trends and patterns and providing insights into market psychology and potential future movements. It’s widely used in charting for visualizing market trends, creating trading indicators like moving averages and Bollinger Bands, and backtesting trading strategies.

CoinAPI offers OHLCV updates for each symbol, with periods from 1SEC to 1MIN. Updates are sent when a period closes or every 5 seconds if the period has been updated but not closed, ensuring users have timely and accurate data for analysis and decision-making.

Derivative Tick Info

CoinAPI’s Derivative Tick Info provides essential data points for navigating the derivatives market, including:

Open Interest: The total number of outstanding derivative contracts, offering insights into the market depth and trader commitment.

Funding Rate: The fee exchanged in perpetual contracts, reflecting the cost of maintaining positions and the degree of market leverage.

Mark Price: The fair value of a derivative contract, used primarily in margin calculations to ensure fair trading.

Index Price: The current price of the underlying asset in a derivatives contract, is crucial for contract valuation.

This data is critical for participants in the derivatives market, aiding in understanding market dynamics, risk management, and assessing market health and sentiment. Traders use this information to gauge market sentiment, develop hedging strategies, and perform comprehensive risk assessments, making it an invaluable tool for informed decision-making in the dynamic world of derivatives trading.

Liquidations

Liquidations in trading occur when an exchange forcibly closes a trader’s position due to their margin balance falling below the required maintenance margin, a measure to maintain the trading system’s integrity. These events are significant indicators of market volatility and the level of risk traders are taking on. High volumes of liquidations typically suggest extreme market conditions and can signal impending shifts in market dynamics.

This data is vital for thorough market analysis, aiding in evaluating market sentiment, identifying potential reversal points, and forming part of effective risk management strategies. Understanding trends in liquidations allows traders and analysts to gain valuable insights into current market conditions, enabling them to tailor their strategies more effectively.

Trade volume data

Trade volume data measures the total cryptocurrency traded on an exchange within a specific period, acting as a key indicator of the exchange’s liquidity and the overall activity in the market. Its significance lies in its ability to reflect market dynamics; high trade volumes often correlate with heightened market activity and can signal the strength or importance of price movements. In market analysis, trade volume data is crucial for identifying trends, confirming chart patterns, and understanding supply and demand dynamics. Both analysts and traders depend on this data for informed decision-making, as it offers essential insights into market momentum and potential future trends.

Latest Quotes Data

CoinAPI provides the latest quote data for a broad range of cryptocurrencies, essential for high-frequency trading and strategies dependent on the most recent market data. This service is crucial for real-time trading systems where quick access to current market information is key to effective decision-making. It also plays a vital role in continuous market monitoring, helping traders and analysts keep pace with fast-changing market conditions. Quick traders, in particular, find this service invaluable for its ability to offer immediate updates, allowing them to respond rapidly to market shifts.

CoinAPI ensures users receive the latest updates for any chosen cryptocurrency symbol. New quote messages are triggered with each change in the order book’s top bid or ask level, providing an up-to-the-moment market snapshot. This commitment to delivering comprehensive, timely market data is exemplified by our Order Book Level 1 Feed, designed for efficiency and speed in updating the latest market quotes. CoinAPI’s blend of speed, precision, and thoroughness makes its latest quotes data a critical tool for traders and analysts in the ever-evolving cryptocurrency market.

Raw data

CoinAPI distinguishes between aggregated and raw data types to cater to diverse data analysis needs. Aggregated data types, such as OHLCV and Exchange Rates, require a specific time period for aggregation, with our datasets starting from a minimum interval of 1 second. On the other hand, raw data types represent the pinnacle of real-time information, capturing every market nuance as it happens. This unaggregated, real-time data is disseminated continuously, ensuring that every update is promptly available. For those seeking the most granular level of market data, our historical API and flat files offer tick-by-tick data, accessible through our dedicated platform, Cryptotick.com.

Providing the most detailed and granular data, raw data types are particularly valuable for custom analysis and the development of unique trading algorithms. Institutions and advanced traders leverage this data for conducting comprehensive market analysis, developing proprietary trading models, and for extensive research purposes. This level of detail and immediacy in data provision makes CoinAPI an essential resource for those requiring in-depth, real-time market insights.

Flat Files

CoinAPI’s Flat Files S3 API, a vital part of CoinAPI Cryptocurrency Data Types, is a RESTful interface designed for seamless access to data stored in flat file formats. This API is in line with Amazon S3 standards, offering the flexibility to integrate with existing Amazon S3-based infrastructure. While it shares similarities with Amazon S3, the Flat Files S3 API is specifically tailored for listing and downloading files, and does not cover the entire spectrum of Amazon S3 features. This specialized approach ensures that users can efficiently manage their data retrieval needs, a key aspect of utilizing CoinAPI Cryptocurrency Data Types, especially when accessing and downloading the extensive data archives provided by CoinAPI.

Conclusion

CoinAPI empowers users with the tools to make informed decisions, supported by detailed and real-time market insights. As a comprehensive cryptocurrency exchange API, we offer a wide array of data types, catering to various needs in real-time trading, historical analysis, and algorithm development. Our commitment to providing detailed, real-time, and diverse data types makes us an essential resource in the ever-changing landscape of cryptocurrency trading and analysis.

Ready to elevate your trading strategy? Try our API today and explore our pricing options to find the perfect fit for your needs.

More articles you might like:

Understanding OHLCV in market data analysis

The Role of EMS Trading API in Portfolio Management

Optimizing multi-exchange trading with Market data API and EMS Trading API

Stay up-to-date with the latest CoinApi News.

I Agree to CoinApi’s Privacy Policy*